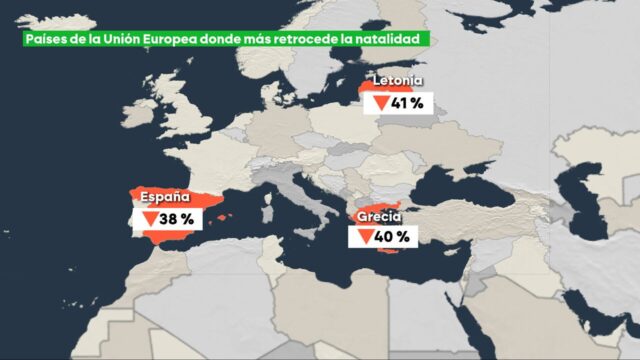

Birth in Europe is located on floors, with descents in the vast majority of countries compared to 2008. Spain is the third in which the birth fell the most (38%)Only with Latvia (41%) and Greece (40%) ahead. And 519 779 Spaniards were born 15 years ago compared to 322 034, who did this in 2024.

A situation that is aggravated if we look at CantabriaWhich becomes the region of the entire European Union (EU), which will record a greater decrease by almost 50%. Behind, at the national level, the principality of Asturia, where they fell by 45%, and Rioha with a fall of the genus by 42%.

While there are some who want to be fathers or mothers and evaluate the barriers that prevent this, there are directly those who decide not to do this. Both options They leave AIKs without workBecause the presence of a child for some was a luxury.

Namely, economic difficulties or the lack of stable work are factors that add to the aging of the population as variables that contribute to the fact that families should postpone motherhood or even abandon it. In addition, this “we become independent much later (…), of course, of course, The rice passes a little“

In fact, most young people agree with the absence Conciliatory policy and family supportAs they say, only then they can rethink one more, although they admit that “as soon as your child has appeared, life is quite complicated.” If not, they tell parents that “with camps” have a lot of bad ”, given the need to make juggling. “