According to the report published by the Zaman Al -Wasl Syrian newspaper, these amendments were replaced by the status of the “Palestinian -Syrian” phrase “Palestinian resident” in civil documents and the removal of the province’s category, which referred to the residence (for example, Damascus or Alepo), and replacing it “Foreener” born “Foreener”, something like “Foreener”, born, born, born on “Foreener”, originally “Foreener”.Field

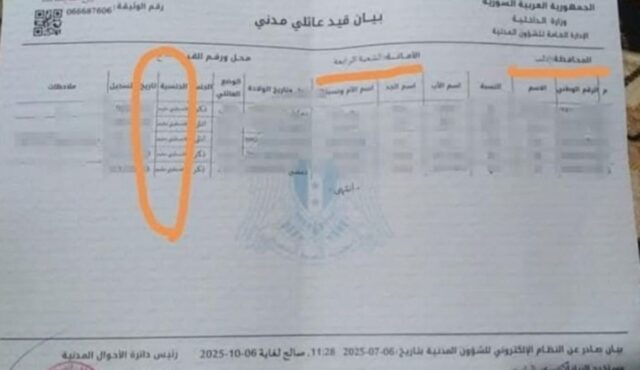

The amendments were clearly displayed in recent official documents, such as “family discontent”, where citizenship was included as a “Palestinian resident” instead of the “Palestinian Syrian”, and the province’s box was also removed in favor of the general description of the “foreigner”.

🔴 The time source for Al -wasl: the new Souls documents delete the “Palestinian Syrian” and replace it with the “Palestinian Palestinian”.

And Gormansa – “Foreign Man” #Zaman_al

A special source showed Zaman al -Vasl that the souls of souls in Syria began to issue official documents with fundamental amendments to the civil notes of the Syrians, where the adjective was removed … pic.twitter.com/wxrp3sgjgz– Zamalwsl – Al -wasl Time (@zamalwsl) July 10, 2025

This step caused a wide concern among Palestinian refugees and human rights organizations, since it was considered a threat to legal and civil rights that Palestinians in Syria for decades used.Field

Nevertheless, some government sources denied the existence of a decision on a change in the legal capabilities of the Palestinians, and examined what the “technical error” occurred in some areas, such as IDLIB as a result of the merger of civil documents, and promised to correct the defectField

Nevertheless, similar cases were controlled in other areas, such as the countryside of Daraa and Damascus, which caused doubts that it was just a technical error or the beginning of a new policyField

This change threatens if it is established as a state policy, the rights acquired by Palestinian refugees in Syria, such as education, work and ownership, and puts them in the field of “foreign residents” instead of its own status of Palestinian refugeesField

In this regard, human rights and popular requirements arose to restore issues in their legal quorum in accordance with Syrian legislation No. 260 of 1956, which gives the Palestinians the majority of civil rights, not considering foreigners.Field

Until the news of the news, the Syrian government did not release an official comment to clarify this issue.

Source: Zaman Al -wasl+ Palestinian Portal refugees

Read more

Beirut .. UN plans to restore the movement of Syria

Beeut confirmed the passion for the establishment of good relations with Syria, coinciding with the launch of the plan supported by the United Nations to return the moved Syrians to Lebanon to their country, providing financial incentives.