Advertising

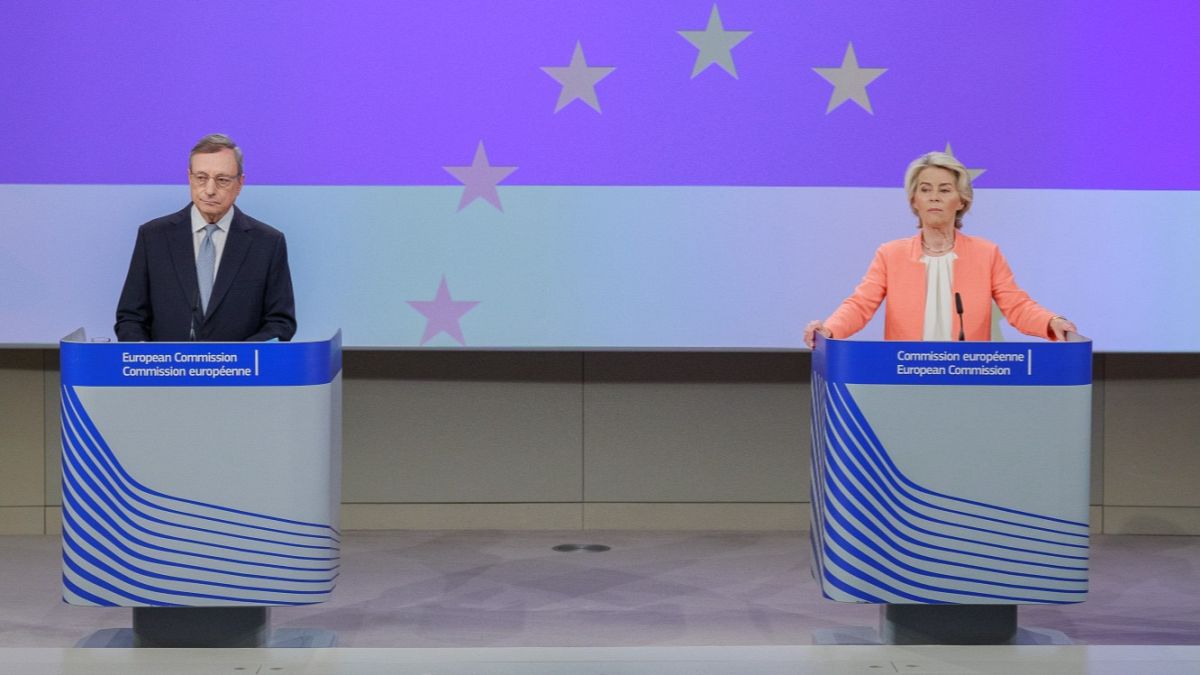

No one likes to play the role of a secondary one, but this is a position in which the EU went to a world heavy scene. This is a cruel assessment that Mario DragoFormer Prime Minister Italy and former president of the European Central Bank for the “events”, which were formed in 2025.

China does not see the European block as an equal partner, the EU plays only one “maximum” role in peace negotiations for Ukraine and has become more than tens of thousands of dead in gas.

According to Drag, the 27th Block can no longer believe that its financial size automatically provides an equal position in world trade and geopolitical. “This year will remain in history as a year when this illusion has disappeared,” he said in speech last Friday.

“Our political organization should be adapted to the requirements of its time when they are existential,” Draga warned.

However, his warning is almost new. A year ago, the former President of the ECB was already alarming for The problem of competitiveness Blok and asked for “radical changes” so as not to stay with the United States and China.

TO The iconic exposition of this He wrote last year, Drahi described the end of the open era based on trade rules and discovered a call for the new EU industrial strategy. Recipe? Less settings, more coordination between member states. There are fewer obstacles in one market, more common investment plans and a deeper completion of capital markets.

But a year later, what did Europe have reached instead?

Ordinary borrowing? Another “no” of the budget conservative countries.

The Dragon report was dominated by discussions, especially from the two aspects: 750-800 billion euros per year are necessary in order to remain competitive around the world and a call for total duty.

In September last year, the report stated that joint lending should become a conventional tool for financing the digital and green transition of Europe, as well as urgently necessary defense capabilities.

In March, the European commission responded with SAFE, a credit program intended to pump up to 150 billion euros from the markets so that the member states can finance defense markets together. Nevertheless, fiscal conservative governments, such as Germany and the Netherlands, remain against everything that looks like Eurobonds released during the Covid-19 pandemic.

Some of these so -called “gentle” states also opposed the proposal of the commission to double the long -term budget of the EU, which today is about 1 trillion euro – by 2028.

“We do not see the need for new resources or new general lending. There is no free lunch there, ”said the Swedish representative of the Swede Jessica Rosencradz at a meeting of EU ministers in Brussels in July.

Nevertheless, many analysts argue that the huge investments necessary for re -equipment in Europe, and its conversions into a more green, more digital economy, are far from introduced, and that the block may soon demand a study of decisions.

“At a time when the guarantor of the International Order, the USA, retreats, and even the united Europe will be ineffective if it does not support its financial power by military power,” said EURONEWS senior partner of Brugeel Gudram Wolf.

The missing part: relief from emissions

Paradoxically, one of the most important omissions in the last speech of the drag was one of the central points of his exhibition: release from carbon.

Miguel is another, senior partner at the Elkano real Institute in Madrid, said that this gap reflects the growing gap between the geopolitical debates and the life reality of many Europeans, especially in countries as Spain, where climate change is becoming more and more serious.

“Trump had a significant impact on the agenda over the past year,” said Efstro Efstro, adding that climatic actions remain politically complex. But he warned: “Removing from reality, which is visible and has huge costs – because we react again, and not prevent – it always turns out to be more expensive.”

European capital markets remain fragmented

As at the Dragment exhibition, the message about the capital markets was clear: the more completion, the better. Nevertheless, the calls for consolidation remain the long -term requirement of Brussels, in which the EU member states themselves have repeatedly resisted.

Financial problems are obvious. Europe is faced with an expanding gap of GDP from the United States from a slower increase in performance and lack of innovation. According to Drag, the bridge of this gap will cost from 750 to 800 billion euros per year in the coming years.

In addition, Europe is currently exporting its savings to increase capital bases abroad, and not invest inside.

To solve this problem, the commission submitted such proposals as the protection plan for 2030, the Association of Savings and Investments and Competition of Competitiveness. But did the EU have reached a “radical change” required by the dragie? Not really.

“What happened this year was more to wait to see what happened in Washington, and then react, instead of realizing many great designs of Draghi exhibition,” said Elkano Elkano Partner Euceronews.

From the point of view of investment, Europe remains far from the scale of the drag.

“General borrowing for general priorities remain unlikely, and the completion of the Union of Capital markets is currently renamed the“ Union of Savings and Investments ” – this will mean a resolution of politically sensitive issues that have been stuck for many years. Therefore, progress in the best case is gradually, ”said Philip Zeigger from Jacques Delor.

The EU, added Zagger, understands his problems and takes steps to cope with them, but the rhythm and ambition are far from the “radical” changes required by today’s changing world.

Reform or “slow anxiety

“If you want to change the world, start with yourself,” Gandhi once said. This is a advice that is not far from the draga.

According to the IMF, if the EU reduces internal barriers to the US level, labor productivity can increase by about 7% in seven years.

Analysts see the same general picture: the growth of aggressive industrial policy in the USA and China, the erosion of polymer institutions and growing attention on economic security rewrote the rules of global competition. Europe has not yet been adapted.

“The development model based on the high dependence of the export and financial system of the United States has become very vulnerable to deep transatlantic friction,” Wolf said.

World trade is currently formed by geo -economics, safety and stability of the supply chain. However, despite the new agreements concluded in recent years, the EU remains dangerous dependent on Chinese imports of rare lands. He also signed a trade agreement with the United States, which critics reject as surrender with Trump.

For many, Trump’s return to the White House was not just a call for awakening, but a complete restoration of the World Trade System.

“Some hoped that the aggressive commercial, as well as the monetary and financial policy of the Trump government, would promp the EU countries to react. But this did not happen, ”said Pierre Zayet, an economist of the Institute of International and Strategic Relations (Iris).

A joint commercial statement in the USA-EU of August 21, perhaps, defended the main interests of the industrial forces of Europe, he claimed, but there is much not enough EU real strategy.

Andrea Renda, the director of the COPS research, was even more direct:

‘EU is faced Possible blackmail From Washington, given the need to ensure US support for Ukraine. But this cannot be an excuse for inaction. The more we expect to differentiate our commercial relations and eliminate barriers in the same market, the deeper we risk falling into this abyss. “

Until now, the EU has focused mainly on statements and relief regulatory burden, with less progress in deeper reforms.

“The most important thing is that aspects of the government of the government are still ignored: there is a need for much larger number of Europe – and for more flexible management the power and potential of the trade union to be fully used,” Randa concluded.