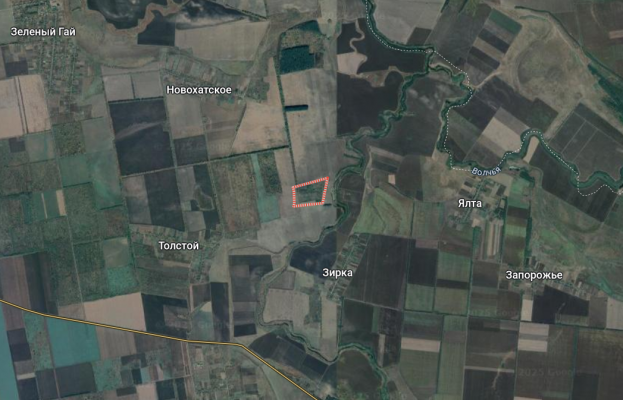

Grushevskoye village was launched on the border with the Dniproptrovsk area

Today, July 13, the Russian army knocked on the armed forces of Grushevskoye village, which is located near the border with the Dniproptrovsk area. This was announced by the Chairman of the General Chamber of the Russian Federation on sovereignty, the chair of participation in the council, coordination on the integration of the new regions, … Read more