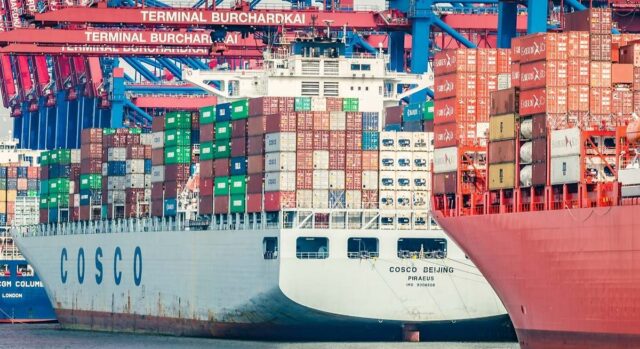

Europe began to become a kind of “Chinese bazaar.” How I published several times Electionomista.esThe tariff war that has encountered the United States with everyone, but especially with China, can cause the redirecting of the commercial flows of the “Asian giant” to the rest of the world and, especially, to Europe. That is, China, with the ability to produce goods that are much superior to their own demand (excess capacity), it is necessary to place all the products that are produced in their factories, and now do not have room on American regiments. The chosen victim was clear from the first moment. Which region is most similar to the United States in terms of size and consumption? EuropeChinese products began to flood Europe, although there are still some nuances that prevent full “flood”.

Since December 2024, the share of all Chinese exports that go to the United States has decreased from 15% to 9%, while the share of Chinese exports to Asia, Europe and Latin America has increased. On the other side, Export to Europe moved from 14% to 16%While sales of the rest of Asia and Latin America also increased. This is the data left by May of the month, and which are collected in one of their last Apollo reports. Although interest may seem modest, an increase in Chinese exports to Europe reveals more, if it suits, when in the end, the effective time of the truce between the United States and China was greater than that of a commercial punishment, in addition to the uncertainty caused by the White House tenant.

Of course, this phenomenon is not new. In recent years, they have spread that China has flooded Europe, for example, with beautiful and cheap cars, especially electric ones. This avalanche has already forced Brussels to take protectionist measures, although hiding in a deep separation between the countries of the community. The world is a “new” place after the pandemic and The old continent is visible at the intersection: China provides you with cheap goods that facilitate the pocket of his passionate citizens, as well as a certain commercial diversification with Washington, rushing up the mountain, but at the same time you see as this triz in the already ancient industry. Another hidden risk is that this product at the price of demolition leads to deflation.

The fact that China displays “small” to the terminals of European extracts Reserve that more warlike is not placed in Brussels to such an extent that Beijing “Monster” from super -powerfulnessThe field with more understandable words: Chinese authorities in recent years have fought with everything with production and innovation, causing a certain imbalance. The approved incentives went to the tireless industry instead of going into the pocket of a terrible local consumer. This caused not only strong production, but also the fact that the Chinese consumer does not buy these goods, generating an even greater excess of them, which Beijing should place abroad.

What began as a deaf echo of numerous analysts ultimately went into warnings about the highest economic levels, since it was clear that the commercial war between the United States and China adopted the revolution. Even before Donald Trump took his gigantic fountain to sign executive orders in the oval office, the Dutch node Klaas, one of the traditional hawks (a supporter of higher interest rates in the face of fear of inflation) of the European Central Bank (BSE) verbalized risks. “There is a possibility that the Chinese begin to offer their products in Europe at more and lower prices. We already see that this is happening on the steel market. Thus, thus, thus China, so to speak, exports its deflation“He said in an interview.

When it was calibrated before the day of the release that for China, the tariff is much higher than 10% of the universal rate that will be used for Europe (the script that can still occur) will act, analysts warned of the “violating” that it could be “good to reduce the demand of the Chinese or cause a mass deviation from the yuan, or/or the promotion of Chinese manufacturers or Chinese producers of the Chinese or the Chinese for Chinese producers either encourage Chinese manufacturers, or encourage Chinese manufacturers, or encourage Chinese manufacturers, or for that more violently compete with European suppliers Outside the American market, ”said Gilly Gilles, chief economist AXA IM.” The political response from China, which is transferred to the growth of production and supply of goods to the economy outside the United States, can aggravate the disinflation pressure in Europe, ”UBS, Dean Turner and Matthew Gilman.

Go down from the general to a specific, is undoubtedly that Europe is especially exhibitedThe field “USA, Japan and some developing economies (as India) has reduced its import import from China since 2015, while the Eurozone has increased its own, which is an additional risk that their economy, relatively open to trade, is disproportionately raised by the subsidized export of China” confirms an independent article of ECB alistair economists DIEPPE, IVAN FRANKOVIC and My Liu.

This situation is especially cut in very specific sectors. For example, the import of the EU from China is about 29% of it Wind turbines and components and approximately 68% of their Thermal pumpsA field of some analyst slipped from the fact that the old continent is the “green prisoner” of China to the extent that the Asian giant dominates the supply chain of these new industries, and Europe wants to speed up the passage to the world without polluting emissions. “China is increasing enormous power within the framework of green technologies, and especially European markets will be flooded with subsidized Chinese solar panels, electric cars and wind turbines until 2024/2025, since China brilliantly provided a strong supply chain that makes it It is difficult to compete with European companies“Andreas confirms the wall of Larsen, who was from Nordea.

More offers through a commercial “triangle”

Despite everything, the arrival of Chinese products in Europe could be much more if it did not get out of Chinese skill sneak up to your assets in third countries Which then overestimates them in the United States. As JP Morgan indicates in his report Trade, tariffs and transportation“Inford incentives in Asia are especially high” from a huge difference in the type of tax (tariffs): while China has encountered 42% tariffs, most countries of Southeast Asia are faced with 10% or lower rates. This gap has forced many Chinese exporters to reorganize their logistics routes to send products to the United States through countries such as Vietnam or Thailand, where they are marked as local production To avoid high tariffs.

The most obvious result of this practice is the collapse of China’s direct export in the United States, as noted above, which in the period since March and, possibly, fell by 40%. However, as JP Morgan Economists emphasize, “this loss is compensated by an increase in exports to the ASEAN and the rest of the world (including Europe).” The data show that since November, Chinese exports to ASEAN (Association of Nations of Southeast Asia) have increased about 30%during the annual rhythm, while their supplies to the rest of the world have increased to 10%. Part of this product is sent from these countries to the United States, which explains the parallel rebound from exports from Vietnam and Thailand to the US market.

This phenomenon created what JP Morgan calls “Commercial triangle”: China exports to ASEAN, ASEN exports to the USA, and, along with it, the effect of American tariffs indirectly decreases. Vietnam, in particular, becomes the main mediator: “Vietnamese exports in the United States in May grew by 12%monthly, and its annual impulse reaches 74%”, which can hardly be explained without the “translation” component. In the case of Thailand, parallel evolution is observed: their imports are increasing compared to China and at the same time, their sales are caused by the United States.

The consequence of this scheme is that “an effective tariff rate imposed on the import of the United States is lower than the static analysis suggests.” JP Morgan evaluates that EThis distraction of commercial flows reduces effective tariffs in percentage termsfrom 14.3% to 13%. Although this may seem insignificant, this is about 10% of the increase in the tariff used in 2025, and has a significant macroeconomic effect. In addition, since this restructuring of logistics takes time, it is predictable that transportation will increase even more in the coming months, deepening the change in traditional trading channels.

Finally, this commercial strategy raises a serious threat to the US tariff architecture and Europe, which will receive an avalanche of goods at the price of balance. The report warns that “the differentials of tariffs between Asian countries will not remain on time”, unless Washington accepts this practice or does not enhance control over the rules of origin. None of these options seems likely in the short term, which can lead to forced comparison of tariffs: either a decrease in tariffs with China, or loading tariffs of Vietnam and Thailand, countries that were already objective with tariffs of 46% and 36%, respectively. Thus, Transford appears not only as a logistic patch, but also as one of the most controversial issues in the commercial war between China and the USA. Everything that cannot be “casting” in Transhipdo will end in Europe one way or another As you can see. The old continent turned into a new “Chinese bazaar”.

![Manila vs Osceola: Battle for Arkansas Gridiron Glory Kicks Off[/gpt3]](https://topbuzztimes.com/wp-content/uploads/2025/07/hss.webp-100x75.webp)